Thus, how does Metatrader 4 make profits? Based on the MQL 4 programming language, this system was created. Users are given all the resources they need to do market research and engage in trade activities. This application is a mobile adaptation of a similar PC terminal. There are three different versions of copy trader mt4 are desktop and laptop applications, a web-based platform, and a smartphone app.

This application can

be used as a standalone item or as an add-on to a full-sized terminal. The

three versions instantly share data by connecting to the same cloud-based

servers. Functionality across platforms is made possible by this.

Traders can open,

manage, and close positions from various devices throughout the day. Free MT4

download is perfect for someone who needs to swap platforms often on the go. Here

are some of the primary characteristics of the mobile terminal.

You can adhere to the

following action plan:

Find an appropriate

broker and platform for copy trading after reading our reviews.

Review all of the

important work requirements.

Make use of a demo

account to test the system.

Find a few traders to

imitate.

If it works, put a

little money into the account to start.

Manage the risks and

occasionally adjust the portfolio's composition using programmers’ and

projects.

You may want to think

about raising your investment cap if you have had strong returns for more than

a year.

Does MetaTrader 4

have a price?

Whether you have a

demo or live account, MetaTrader 4 is free to use. Despite this, when you

purchase or sell securities like forex and CFDs, your broker may still be

charged spreads and commissions (or market-maker).

Depending on the kind

of live account you have, holding trades overnight may incur carry costs or

overnight rollover fees (Sharia-compliant accounts are usually interest-free

but may incur other costs).

Does MetaTrader 4

charge a fee?

The owner of the MT4

platform never charges you any commissions, but brokers may do so through the

MT4 or MT5 platforms, depending solely on the type of account you register,

which differs per broker.

The MetaTrader 4

platforms may be provided free of charge by forex brokers; however, trading

commissions will still apply (regardless of the platform you choose). The

broker and its account offerings determine whether your broker will charge you

a commission, spread, or a combination of these trading expenses.

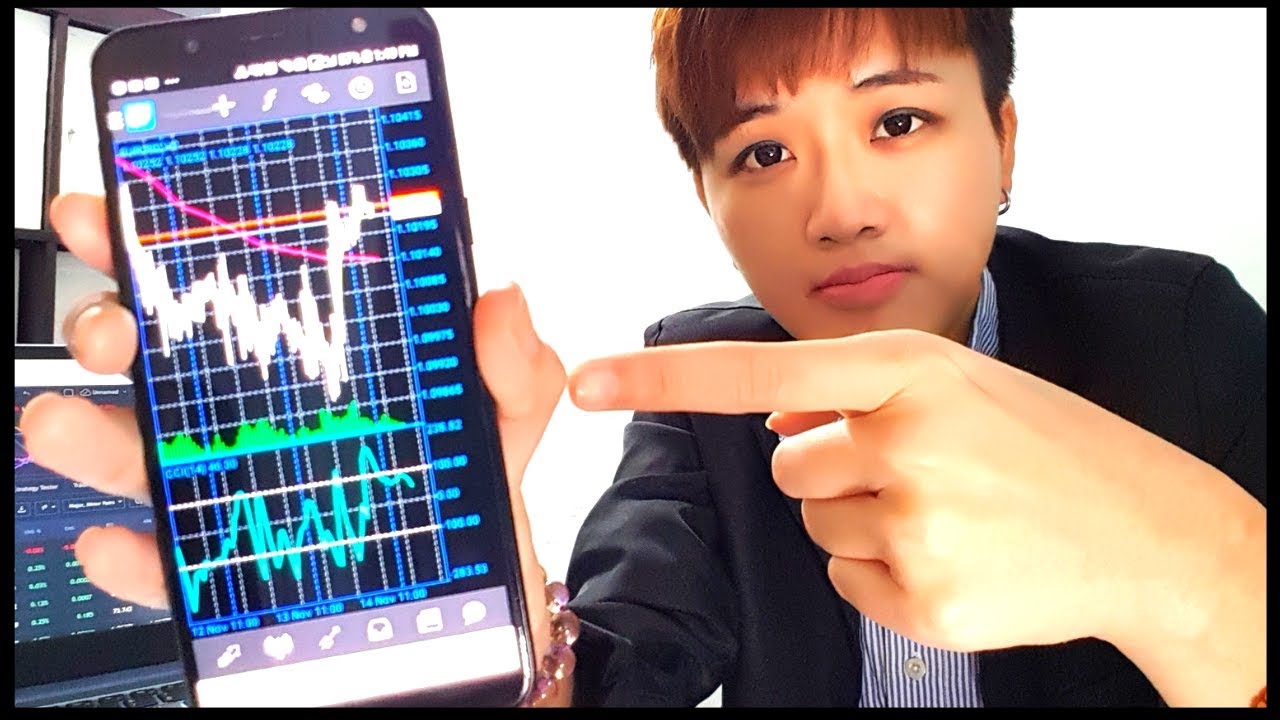

Charts for MetaTrader

MetaTrader 4 and

MetaTrader 5 offer a user-friendly interface with templates that may be

customised to change the way basic charts look. Although the exact number

varies, a few dozen charting tools and chart patterns are often available,

giving traders a decent place to start when undertaking fundamental technical

indicators. The workspace, including all trend lines and chart setups, is fully

backed up by the traders' ability to keep all their charts within their

profiles. Some cm trading reviews shows that it’s a scam not a trustful

platform.

Is MetaTrader

automated trading risky?

Yes. The automatic

trading platforms known as experts in MT4 are created by traders and rely on

backtesting to demonstrate their profitability. The idiom "previous

performance is not indicative of future results" is well-known in the

financial world. Automated techniques have the drawback of relying on the

advantages of hindsight bias. According to the cm trading reviews the CM

Trading has a high trust score of 91 out of 99 and can be considered

a low-risk trading platform.

The truth is that

only a very small percentage of trading strategies are profitable over a full

year.Given this, traders should be aware of the risks and evaluate any strategy

before using it to manage their investment capital, even though utilising an

automated method can benefit.

Here are some

suggestions to assist you in choosing an effective automated trading strategy:

Study and become

familiar with the expert adviser's trading approach for its automated

technique.If possible, backtest the approach using several instruments and

periods to assess its past performance (if available).

Compare the

membership fee and past results to other automated approaches.Once you've

chosen a course of action, please test it out with a small initial commitment,

then gradually raise your commitment size over time.

Well, that depends on

how much you risk on each deal. You can make an average of $20,000 yearly by

risking $1,000. You can make an average of $60,000 per year just risking $3000.